continued from page Board of ….

continued from page

Board of Commissioners on Monday, June 12, and Board of Education on Tuesday, June 20, about the need for relief from escalated tax bills. Commission Meeting

At the Commission meeting on June 12, Amie Vassey presented the facts that she had received from the Montgomery County Tax Assessor’s Office on that same day, which detailed the 19 homes used to determine the rise in appraisals. “That is one-half of 1% of homes in Montgomery County,” she emphasized. “There are 3,800 homes in our County. But only 19 houses were looked at by this company who we paid to do this. I looked through these 19 homes, and of them, around seven homes matched my home as far as structure and square footage. Of those seven homes, all of them were valued at $140,000$150,00, but my assessment says that my home is valued at $204,000. It doesn’t even fit. I thought these assessments were based on uniformity? I’m not saying these evaluations that they are based on is wrong, I’m just saying something was lost in translation.”

She continued, “This type of issue is blanketed over the County. These assessments are grossly, grossly overstated. I’ve been talking with people across the County and one person reported a $100,000 increase. Another person reported $60,000 increase. I think it should have been around 30% of the county surveyed, which would be around 1,100 homes.”

Vassey was joined by several others, who shared their concern at not only the rise in assessments, but also the disregard which they felt leaders had for their constituents.

One citizen who rose to address the Commissioners complained, “The value on my house went up by 94%, and I haven’t done a thing to my house but cut the grass. So, I feel like we are owed some kind of an explanation on our evaluations. We are not here to argue – I know he said the tax rate hasn’t been set yet. But we know our evaluation, and our taxes are based on our evaluation. Anybody with any common sense couldn’t justify almost a 100% increase in a property value when the owner hasn’t done anything but cut the grass.”

Other citizens spoke up, saying things such as, “We are citizens of this county; we are owed an explanation,” and “The Tax Assessor Board will get you nowhere…we’ve all been down that path before.” One woman even shared that she had spoken with the Tax Assessor Board on many occasions about the way they handle business with the citizens of the County, but nothing seemed to improve. “When they get to where they don’t care about the people anymore, maybe they need to be replaced.”

“We’re all in this room, and we’re all upset. Who gets a raise on their paycheck every week? Nobody. You get it? That’s why we’re here. Tell us what we want to hear, tell us the right way!” one man demanded.

Commission Chairman Leland Adams addressed the concerns, explaining, ““Property tax assessments were sent out because your property has been re-evaluated; the form is not a bill, and most of you probably looked at the bottom part of the bill with the dollar figure on it. That uses a millage rate that was set last year for the tax purposes of last year. That millage rate is not correct – that rate will roll back to equal the 2023 dollar amounts that were collected for last year for the budget we are operating on this year. So, the millage rate – we don’t know what it will be, we will not set that millage rate until this August – could roll back to equal this year’s amount. So at this point, there is no tax increase.”

Adams informed the citizens that the millage rate will not be rolled back if the Commission sees that more money is needed to operate the 2024 budget than was needed for the 2023 budget. In that case, there will be three public hearings on the millage rate increase before the Commission votes on the rate.

“The property appraisal form was designed and sent out by the Tax Assessor’s Board to tell you the new evaluation of your property, which has not been appraised or assessed in about three years. With the economy like it is, the cost of housing, the cost of buying and selling and building, the cost of everything has gone up – that’s why there is a large increase,” he added.

Adams advised those who believed their appraised value is too high should discuss the matter with the Montgomery County Tax Assessor’s office.

Board of Education Meeting

At the regular monthly meeting of the Montgomery County Board of Education, the Board provided packets of information detailing the past years’ millage rates and taxes to attendees of the meeting. According to that information, the Board’s millage rate has not changed since it first rose to 15 mills from 14.189 mills in 2017, and is less than Wheeler County’s school millage rate, which is 15.709 mills, but not as low as Jenkins (14.875), Pulaski (13.901), Telfair (14.000), Treutlen (14.010), or Wilcox (14.250) Counties.

This rate of 15 mills brought a total of $6,944,304 to the school system last year, $727,507 of which came from equalization funding. According to these statistics, the value of 1 mill was $161,920.

Members of the Board addressed the issue of property assessment increases with the public and listened as Amie Vassey, Leon “Bubba” Collins, and Jim Paul Poole all asked the Board to lower the millage rate to the minimum amount required to receive state equalization funds, which is a rate of 14 mills.

“I can promise y’all we will do our due diligence to do the best that we can in the situation that has been presented to us. Once we get the tax digest, we will have a look and let it direct which way we need to go. However, we are kind of mandated by the state legislature in how far we can move with the mills,” Board Chairman Henry Price said as he opened the meeting.

Vassey approached the Board first, saying she had not planned to attend the meeting, but a concerned citizen shared with her that she could not truly address the tax issue without addressing the school board. “The school board is half of the issue that we have, so, of course, we need to bring our concerns here as well,” she said.

“I appreciate each and every one of you – I want to make that clear,” she emphasized. “I think most of us are here tonight seeking to understand, to listen, and to learn. I did read your packet, and I want to say that transparency is a key characteristic of good leadership, and I appreciate you guys putting that together for us. It is very informative and very helpful, and we don’t get that in other places.”

Some concerns which Vassey voiced arose through her review of the school’s financial records, which she found on the school’s website. “It outlines everything – all of the expenditures and all of the revenues for the Board and school system,” she said.

Vassey continued, “One thing I noticed was between years [20212022] and [2022-2023], there was an uptick in expenditures by almost $2 million — $1,829,454.35 total in the last two years. That greatly concerned me, and I would be interested in knowing what was driving that, as I’m sure the rest of the residents would [also].”

She asked that the Board be proactive in defining some financial areas which seemed vague and unclear to the average citizen. “There were graphs breaking out where out money was going. There were some things that were very vague to me. As a taxpayer, I am not satisfied with the description of where this money is going. It was things like support services – business, support services – central, and support services – other – I’d like to know the difference between those. What is that specifically? Where is my money going?” Vassey told the Board.

“Again, we appreciate all of you. I believe in education; I am an educated woman. I went through this school, [and] I wouldn’t be where I am today without it,” she remarked. “But, I was looking up the Quality Basic Education Act, which governs the way we run public school systems, and the state only requires you to charge us 5 mills. I understand from reading your provided paperwork that we want to be a 14 or higher so we can get that additional grant money [through equalization funding]. I get that; I’m fine with that. At this point, if we could get to that 14 mills point, I think that as a county, we will be happy with that.”

Collins followed after Vassey and shared his concern for the effects of the raise in values on senior citizens. “I don’t have a kid in school, but what I’m hearing is that Montgomery County is doing an excellent job with their students, so I want to congratulate y’all on that,” he began. “But I’m a senior citizen – Montgomery County has a lot of senior citizens, and I know y’all didn’t set the values, but my and my wife’s property taxes went up $1,600 based on last year’s millage rate. When you don’t have a job or have any more income coming in, it’s tough.”

He continued, “Part of this issue is the county and part of it is the school board. We would like for y’all to consider rolling the millage rate back to 14 mills. It’s a little bit high for most of us.”

Collins also asked the Board to look into the possibility of exempting senior citizens from paying school taxes, as he stated he learned some of the large counties, such as Cobb County, has done.

Former Board of Education Chairman Jim Paul Poole shared his perspective on the tax issue with the Board, and also requested that the millage rate for the school district be rolled back to 14 mills. “We don’t want you to consider anything that will lower the quality of education that you are now providing for our kids,” he emphasized. “You’re doing a good job. But we’re in a situation right now nationwide – not only countywide — that has these taxes going sky high. I know the Board has worked for several years to not raise the millage rate above 15, which the state requires you to have to get the maximum amount of state funds. You have the ability now to lower it 1 mill, which I believe will make a lot of difference with the present tax situation.”

Chairman Price responded to the concerns. “Again, we appreciate everyone that came out tonight to speak with us. We welcome you to any of our regular meetings and we welcome your conversations on the street,” he said. “We value your comment, we value your conversation, and I assure you that we listen to your thoughts and consider them to try to make the best decisions we can for the group as a whole.

Superintendent Stan Rentz also spoke up about the situation. “When I heard some of the numbers of the tax bills from not only people sitting on this board, but also other citizens, I certainly understand the concern. It is valid, it is a reason for concern, and I appreciate you all sharing your questions and thoughts. I am going to get you some answers,” he remarked. Tax Assessor Meeting

The Tax Assessor Meeting on Thursday, June 22, was another standing room only meeting, as citizens filled the meeting room and hallways to voice their frustration with the situation.

With both the county attorney and the contracted mass appraiser present for the meeting, community members took turns asking about the practice of the assessment and sharing the need for transparency within the local government.

According to Montgomery County Chief Appraiser Julie Adams, each year, one-third of the county properties are visited by an appraiser, which ensures that every 3 years, all properties have been seen by a county official. Dr. Anna Gilreath spoke up and asked how the homes visited were determined, which Adams said was by map.

Another concerned citizen shared that she did not understand how value of older homes were determined, because she and a neighbor’s home, which were built within different decades and had similar structures, had the same value. The Board informed her that the current market value of supplies was considered within the assessment, along with a rate of depreciation. Linda Page also addressed the Board in the meeting, stating that there needed to be more communication between the local government and taxpayers. “We need to be informed. I want to know where my money is going,” she emphasized.

Page went on to share about the inequality of spending within the County, as she said that several purchases were made each month for various departments in the county, yet Adams’ tax appraisal vehicle was in terrible condition. “I wouldn’t drive it. I wouldn’t let my kids ride in it. But yet that is what we expect her to drive around the county in,” she told the Board.

Several others spoke up sharing their own experiences with what they felt was unfair taxation, assessment practice, and/ or frustrating government practices.

Amie Vassey continued to be a voice of the people, as she shared the tax laws that she had discovered to be violated by the recent assessment. She recited O.C.G.A. 485-2, which states that all property must be returned and assessed at fair market value each year, and that counties are required to establish this value by January 1 per Georgia law. She also shared that according to the state’s “Assessor’s Timeline,” these assessments are suggested to be mailed on May 15, but that they must be mailed by July 1.

Vassey referred to the list of 19 home sales which were used to calculate the change in property values within the area, and noted that 5 of these sales were continued from page

completed after the January 1 deadline, as they occurred on March 9, March 16,`March 24, April 17, and April 28 of 2023. She emphasized that the date of these sales makes it impossible for the assessments to have been completed by the state deadline.

In addition, Vassey informed the Board of Tax Assessors and the public that the Georgia Tax Payer’s Bill of Rights had been violated, as it states that if a tax assessment increased by 15% or more, the notice must include a “simple, nontechnical explanation of the basis for the change along with a statement informing the property owner that they may view or have inexpensive copies made of those tax records used by the assessors to determine the value change.

“This Board and this tax appraiser, whoever is involved in it, they have violated two specific state Georgia laws – they have taken our assessments after the deadline, January 1, which is illegal, and they also did not send us a notice in our assessment form explaining the reason for the increase. If your value increased over 15%, they were required by law to send you an explanation in your envelope. Two Georgia state laws have been broken – it is that simple,” she stated.

Vassey continued, “I need a verbal commitment [from this Board] that this assessment is going to be thrown out, [and that] we are honoring last year’s values. That is all we can do at this point. Otherwise, it forces us into further action.”

“Improper taxation is the type of issue that moves entire societies to revolution – think the American Revolution. Now, do we want Montgomery County to do something like that? Absolutely not. Would we do something like that? Absolutely not. But in today’s world, there are legal paths for us to address very specific issues – the framework is already out there; we don’t have to reinvent the wheel. I don’t have to come up with it, yu don’t have to come up with it – all we have to do is look it up and follow the law, which is what I’m asking you to do,” she told the Board. “That’s what I expect. I want a verbal commitment tonight from you guys [that you will right this wrong] or starting tomorrow, I will make it my sole mission to file an inquiry into your board, and we will remove every single one of you.”

Board of Tax Assessors Chairman Jesse Fountain recommended that the 2023 assessments be thrown out, and the other Board members present – Nina Thompson and Daniel Chadwick Harrison – seconded the motion, voting unanimously. Board Members Maecon Beard and Joyce Allen were absent due to medical issues.

Fountain provided a comment on the vote after the meeting. “We basically killed our own evaluation and said we are going to roll it back to 2022 and start forward again,” he explained. “I’ve never done this, I can’t tell you what the shot of this is going to be. I still think there will be a 30% increase in values, and then next year, it’s going to be there again. So, we’ve just kicked the can down the road in my personal opinion,” he said.

He continued, “If we don’t get this done in time to meet the state’s deadline, I can’t tell you [what the impact will be on the county commissioners]. I don’t know – but, it’s not going to be good.”

According to the Montgomery County Tax Assessor’s Office, the appeals filed in conjunction with the Assessment Notice of June 9 are now no longer valid. The updated assessment notices are scheduled to be mailed mid-July, if not sooner. If at that time you still wish to file an appeal, you will be able to do so in the time frame outlined by the revised notice.

If you have any questions or concerns, please feel free to contact our office Monday through Friday, from 8:30 until 4:30 at 303 South Richardson Street, Mount Vernon, Georgia 30445 or call 912583-4131.

NEED FOR TRANSPARENCY – Among Linda Page’s concerns was the need for transparency within local government, as she emphasized that as a taxpayer, she would like to be aware what the county funding is being used for.Photo by Makaylee Randolph

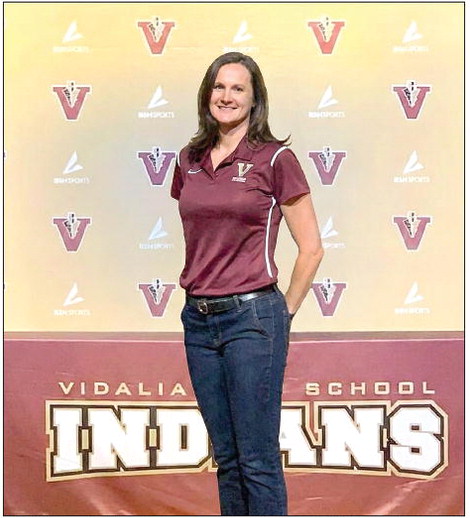

SPEAKING TO THE BOE – Citizens, such as Leon “Bubba” Collins (pictured here) also spoke to the Montgomery County Board of Education at their meeting on Tuesday, June 20, and asked them to lower the school millage rate to 14.Photo by Makaylee Randolph