What Difference Can a Penny Make?

Wheeler Officials Weigh in on T-SPLOST

(Editor’s Note: When voters participate in the May 24 General Primary, the ballot will include a very important question affecting the future of the transportation infrastructure in this region. Voters will be asked whether they support the renewal of T-SPLOST. In an effort to acquaint readers with what the 1% Transportation Special Purpose Local Option Sales Tax has accomplished in this area in its last 10-year cycle and what it could mean for the next decade, The Advance is publishing a series of articles highlighting T-SPLOST’s impact on three counties in the newspaper’s coverage area: Wheeler, Montgomery and Toombs counties. First up is Wheeler County.)

“It’s a godsend. Without T-SPLOST, we would have to raise taxes,” said Wheeler County Commission Chairman Keith McNeal, noting the mostly rural, low-population, low-wealth county is dependent on special option funding to finance expensive roadwork.

Because of T-SPLOST in the last 10-year cycle, Wheeler County was able to replace two bridges, one on Snowhill Baptist Church Road and the other on Mt. Olivet Church Road, at a cost of about $1 million per project, McNeal said. Additionally, the county was able to buy road graders, dump trucks, and an extended arm mower, among other equipment necessary for keeping roads in good repair. In outlying Wheeler County, most roads are unpaved, and require constant attention to accommodate traffic, including school buses and heavy equipment used in logging and timber production, among Wheeler’s major industries. McNeal said the next cycle of T-SPLOST funding has been designated for repaving the heavily traveled Spring Hill Road from U.S. Highway 280 to the Spring Hill Community and on to Sandpit Road and the county line. G.M. Joiner, mayor of Glenwood, one of Wheeler’s two municipalities, echoed MacNeal’s sentiments about the need for T-SPLOST. “These smaller communities cannot generate enough tax money to fix all of our streets and roads.” Joiner pointed out that over the last 10 years T-SPLOST has enabled Glenwood to practically resurface every street in the city. “We used all of ours for resurfacing. We don’t have any streets that are traveled a lot that are unpaved.” He said that there may be a misconception about where the T-SPLOST funds are used. “That money comes back here. It is not going to Atlanta. It is raised here and spent here. How can you not be for that?” Glenwood plans to spend most of the next cycle of T-SPLOST funds on new construction of a sidewalk of 5 feet by 3300 feet from U.S. Highway 280 Connector (5th Street) to the Apple Apartment Complex, a stretch of road that sees a lot of foot traffic. Two dirt streets are also scheduled to will be paved. Jeff Floyd, City Manager of Alamo, the other Wheeler municipality, said the projects that TSPLOST funds in Alamo benefit not only that community but the entire county. “It helps the community in several ways— in infrastructure and in commerce. “The better a community looks, the more attractive it is to prospective merchants.”

In Alamo, a big chunk of the next T-SPLOST funds are designated for the repair of a sidewalk fronting a line of businesses on Railroad Street. The sidewalk is not only unattractive it is also a safety issue. Buckled and broken, the sidewalk slopes at precarious angles in some spots. Floyd estimates part of the sidewalk may date to the early 1900s when it was installed by early merchants. He said plans call for replacing the sidewalk with a new concrete walkway with step-downs to accommodate the difference in levels between businesses and the street. Landscaping and new lighting may also be a part of the new aesthetic. The project will extend up and down Railroad Street and cross Highway 126 to front the old hardware store property that the city just purchased and where a community farmer’s market may be located.

In addition to the sidewalk, the projects planned for the next T-SPLOST cycle include paving 10 streets: North and South Jefferson, Magnolia, McRae, Stubbs, East Railroad, Towns, Pearl, North Pine and South Broad.

Floyd said the previous SPLOST cycle enabled Alamo to pave a number of streets and add a bricklined, concrete sidewalk on Lucille Avenue that is used by children walking to Wheeler County Middle/ High School. Coupled with discretionary funds, T-SPLOST was also used to resurface roads in the city’s cemetery.

The Transportation Investment Act (TIA) of 2010, known locally as TSPLOST, was introduced to voters via referendum in 2012 and passed in three of Georgia’s 12 regions, River Valley, Central Savannah River Area, and the Heart of Georgia Altamaha (HOGA) which includes Appling, Bleckley, Candler, Dodge, Emanuel, Evans, Jeff Davis, Johnson, Laurens, Montgomery, Tattnall, Telfair, Toombs, Treutlen, Wayne, Wheeler, and Wilcox.

The measure passed in the HOGA Region by a slim margin—a vote of 52%-48%. Since that time, the HOGA Region has successfully completed 601 projects with 141 more currently under construction. The current T-SPLOST has collected over $290 million in total revenue of an original budget of $366 million. Upon completion, that penny of sales tax will have funded 27 projects in Toombs County, 31 projects in Montgomery County, and 18 projects in Wheeler County.

In addition to the TIA funds to support the aforementioned projects, 25% of all tax collected in our TIA Region was redistributed back to local governments (counties and incorporated cities) for use on any transportation- related projects they chose. The discretionary funds were distributed among the 17 HOGA counties using the Local Assistance Road Program (LARP) formula and allowed communities to tailor their contributions to local transportation needs. In some instances, discretionary funds were used to “match” state and federal funds which is the portion a local government must pay for the project. The match is normally 30%, but counties and cities that passed TIA paid only 10%.

Under State law, TSPLOST is a 10-year sales tax. Everyone participates via sales transactions, regardless of residency, so it is not a burden on business owners or homeowners. Voters may renew the sales tax at the end of each decade. County voting results will be combined to produce a regional total. If a majority of the votes cast in the Region’s election are in favor, then it is considered passed, and the sales tax will continue to be imposed in the entire Region, all 17 counties. In the HOGA Region, renewal of the T-SPLOST will ensure completion of an additional 580 projects with a total project value of over $235 million: 71 new projects in Toombs County, 26 new projects in Montgomery County, and 12 new projects in Wheeler County will move forward if the renewal is passed, and the local community will continue receiving its fair share of future discretionary funds. These projects are particularly critical for our community and the entire HOGA Region because of its geographic location on the Interstate 16 corridor. Current supply chain challenges are projected to last well into 2022. The Georgia Port is projected to process 7.5 million containers this year, an increase of almost 2.5 million over last year. With 80+% of those containers going on a truck, this economic development will create even more wear and tear on infrastructure on the I-16 corridor between Savannah and Atlanta.

Without T-SPLOST, future transportation infrastructure projects will likely have to be paid for by the property taxpayers in each community. This is not a new tax, but the continuation of a current tax. All funds collected in this region for TIA will be spent on transportation projects in this region.

A penny goes a long way.

To learn more about TIA, in general, or past/ future local projects, specifically, visit http://www. ga-tia.com.

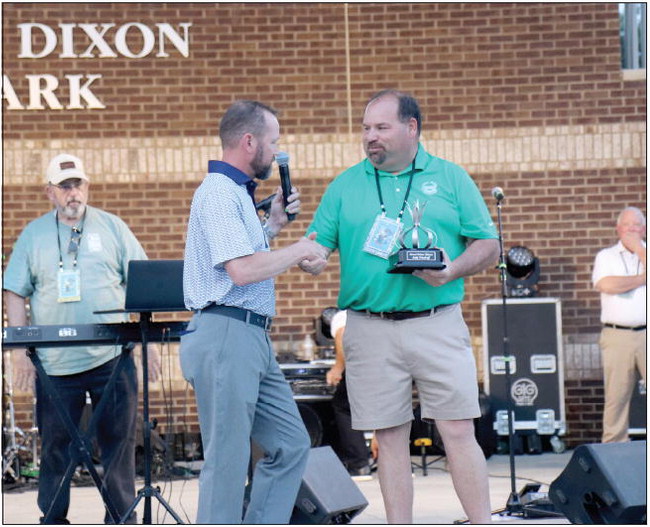

PAVING ALMOST 100% — The last cycle of T-SPOST funds enabled the City of Glenwood to pave almost 100% of its streets. Mayor G.M. Joiner, above, stands at the center of one of the last thoroughfares to be paved in the community. The City has plans for sidewalks if the next T-SPLOST gets a go-ahead from voters.Photo by Deborah Clark

SIDEWALK RESCUE — Alamo City Manager Jeff Floyd pauses on Railroad Street in downtown Alamo where an unlevel and unattractive sidewalk is not only an eyesore but a potential liability. The sidewalk is targeted for replacement with the next cycle of T-SPLOST funds.Photo by Deborah Clark